Carbon Capture Pipelines and Iowa Landowner Rights

A top priority for Iowa Corn is building markets and demand for corn. It’s no secret ethanol is a top market for corn grind, and we are working to increase ethanol’s share of the fuel tank. Ethanol is the most immediate and affordable low-carbon fuel solution on the market today.

Ethanol plants and individual farmers have invested in carbon pipeline projects to gain access to additional markets by reducing ethanol’s carbon intensity score and making it an even lower carbon fuel. Currently there are two carbon pipeline projects proposed to go through Iowa. We encourage farmers to have conversations with the companies as well as seek legal counsel.

Agricultural Landowners’ Guide to Carbon Pipelines

Iowa Corn Growers Association (ICGA), along with legal counsel, developed a carbon pipelines guide for ICGA members and other agricultural landowners to better understand carbon pipelines. Request your own copy of the guide below.

Agricultural Landowners’ Guide to Carbon Pipelines Request Form

"*" indicates required fields

Frequently Asked Carbon Questions

Carbon sequestration and capture can be a challenging topic to navigate. We answer some of the commonly asked questions about carbon below.

“Low carbon fuel” is any transportation fuel from non-petroleum origin that reduces greenhouse gas (GHG) emissions compared to fossil-based gasoline or diesel. Corn ethanol is an example of a low carbon fuel, reducing GHG emissions by 46% on average compared to gasoline. Historically, policies such as the Renewable Fuel Standard (RFS) and the California Low Carbon Fuel Standard (LCFS) have created incentives to encourage the production and use of low carbon fuel. However, we have increasingly seen new low carbon fuel policies being implemented worldwide, including in four of the United States’ top five export markets in Canada, European Union, United Kingdom, and Colombia or domestically in places like New Mexico, Oregon and Washington, with more looking to join. Currently, a top legislative priority for ICGA is a high-octane fuel bill which paves a way to incorporate higher ethanol blends into America’s fuel supply, increasing corn demand.

Carbon intensity (CI) is a measure or “score” of the rate of GHG emissions per unit of energy consumed in an activity or production process. In the context of climate discussions and low carbon fuel policies, fuels with lower CI scores are favored by receiving greater incentives. Therefore, under low carbon fuel policies, fuels such as corn ethanol stand to benefit by lowering their CI scores. Options to lower the CI score of corn ethanol include ethanol plants utilizing low carbon energy like wind and solar power, maximizing efficiency of ethanol plant operations or adopting technology such as Carbon Capture and Sequestration (CCS), which along offers the biggest opportunity to lower an ethanol producers CI score. ICGA continues to advocate for recognition of farming practices like no-till, cover crops and buffer strips, among many other practices, to be included in ethanol producers’ final CI score.

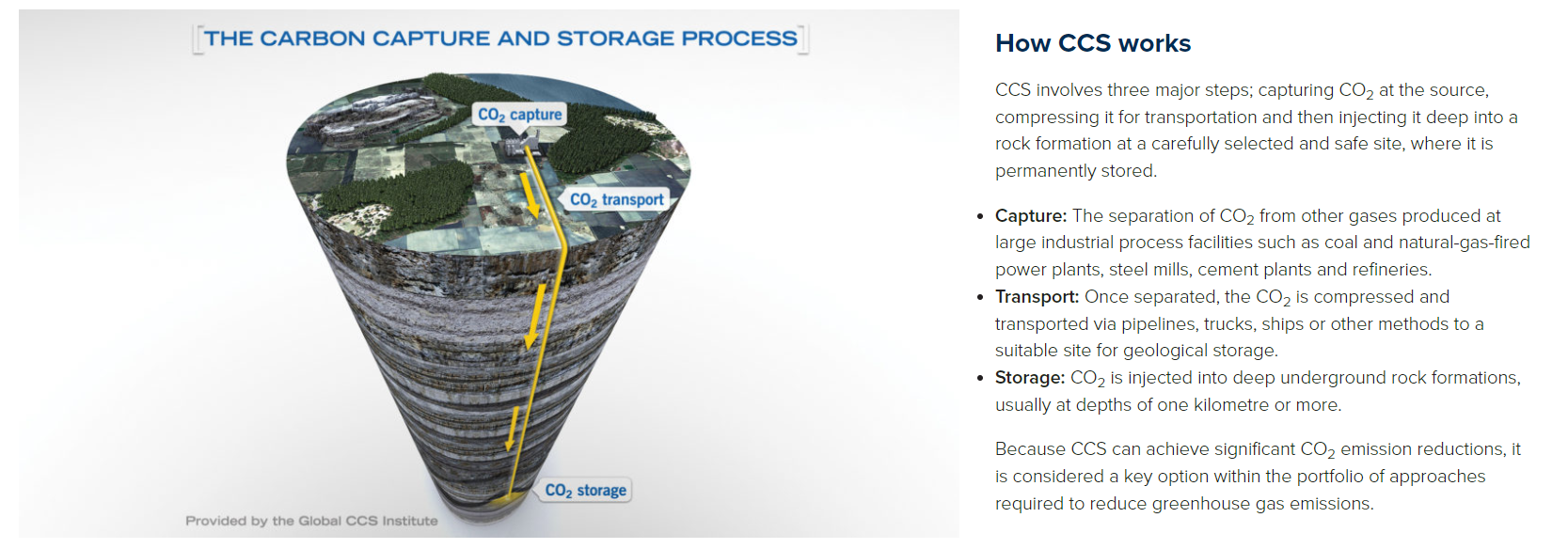

Carbon dioxide emissions from processing facilities like ethanol plants can be captured before the emissions are released into the atmosphere. This captured carbon dioxide can be transported via pipeline, stored in geological formations and injected thousands of feet underground where it is sequestered under layers of impervious rock. The carbon dioxide then can convert into calcium carbonate (limestone), resulting in a net reduction of atmospheric carbon through plant growth, corn processing and CO2 storage. However, carbon dioxide could also be converted into useful chemicals like methanol, plastics or even more ethanol. The conversion and utilization of carbon dioxide can be done on-site at the ethanol plant or transported via pipeline to a centralized location for economic and efficient conversion.

Iowa Corn supports all methods for lowering the carbon footprint and carbon intensity score of fuels and chemicals derived from corn, including CCUS on-site at the corn processing facilities or transfer to a centralized location via pipelines when needed.

The Carbon Capture, Utilization and Storage Tax Credit, also known as 45Q, based on its section in the tax code, incentivizes carbon capture and sequestration practices. Originally started by the oil industry in 2008 for enhanced oil recovery (EOR), the federal government in 2022 increased the existing 45Q tax credit to $85/metric ton (which is approximately $0.17/gallon of ethanol) for CO2 that is permanently sequestered underground and $60/metric ton for CO2 that is used for EOR or other industrial uses. Companies must begin construction of the sequestration project by January 2033, which is a seven-year extension of the tax credit. To be eligible to receive the tax credit, carbon emissions must be measured at capture as well as injection and meet specific sequestration storage requirements set forth by the Environmental Protection Agency (EPA) or other approved overseeing agency.

The Clean Fuel Production Credit is also known as the 45Z. In 2022, the federal government created the 45Z tax credit, which offers all fuel producers, including ethanol plants, an incentive to reduce their carbon intensity score below 50 kg CO2 equivalent. For every one carbon intensity point reduction below 50 kg CO2 equivalent, a fuel producer gets about $0.02 per gallon tax credit. For example, reducing a carbon intensity score from 50 to 26 kg CO2 equivalent would result in a $48 million tax credit for a 100-million-gallon ethanol plant (50-26 x $0.02 x 100 million). The 45Z tax credit was recently updated in the One Big Beautiful Bill Act (OBBBA) to sunset in 2029.

As defined by the Iowa Utilities Commission (IUC), generally, eminent domain is the government’s power to take private property for public benefit. It comes from the U.S. Constitution, federal laws, state constitutions and state laws. The IUC’s authority to grant the power of eminent domain comes from Iowa Code Chapters 476A, 478, 479 and 479B. Chapter 476A is for electric power generating plants, Chapter 478 for electric transmission lines, Chapter 479 for intrastate natural gas pipelines and Chapter 479B for hazardous liquids pipelines. Telephone and telegraph companies are granted the power of eminent domain by statute, Iowa Code Section 477.4.

Additional information: